Unlocking the Benefits of a Personal Real Estate Corporation: A Guide for Realtors

What is a Personal Real Estate Corporation (PREC)?

A PREC is a personal corporation that real estate agents and brokers can establish. And this is brand new legislation that was enacted in Ontario on October 1st, 2020.

How Does PREC Work?

A Personal Real Estate Corporation (PREC) is a legal entity that allows real estate professionals to conduct their business in a corporate structure. As it is just for real estate salesperson and broker, it is also a professional corporation. You, also referred as controlling registrant of the corporation, are the sole holder of all the voting and make all of the decisions for your PREC. However, non-voting shares can be distributed to your family members for income splitting purposes.

PREC will be independent, meaning it will earn revenue and pay tax on its net income. Simply put, your brokerage will pay PREC for commission and HST instead of you. A corporate tax will be applied and annually corporate tax will be required to be filed.

Landing page builders typically include features like form builders, A/B testing, analytics, integrations with other marketing tools, and more. They eliminate the need for hiring a web developer or designer, allowing marketers to have full control over their landing page creation process.

The Advantages of Operating as a Personal Real Estate Corporation

There are quite a few benefits of incorporating as PREC instead of working as a solo-proprietor. Few of the highly beneficial ones are discussed below:

Tax Deferral Vehicle: The biggest benefit of any corporation is to defer taxes (or even reduce it). Assume you are an individual without a PREC who is likely going to earn a commission of more than $220,000. For any dime over $220,000, you will fall under the marginal tax bracket of 53.5%. However, in PREC – you will be considered paying a rate of 12.2% only. But this does not consider money coming into your pocket. This only means the taxes PREC would have to pay. (Remember you are either an employee or a shareholder of a PREC, but you are NOT a PREC).

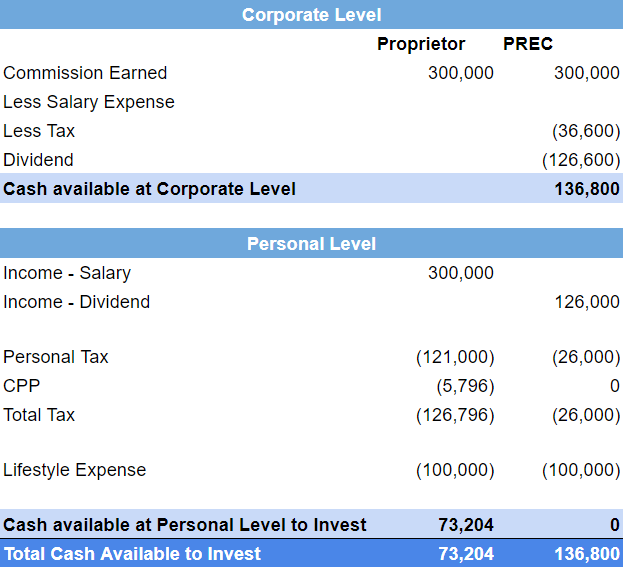

If you earned a commission of $300,000 as Proprietor vs having a PREC, and you only need $100,000 for sustaining your lifestyle, then you would have $73,000 in your pocket to invest, compare to $136,000 to invest through PREC itself.

Income Splitting Opportunities: Secondly, one of the best way to optimize your tax strategy is Income splitting with family members or employees. However, thorough understanding of the Taxable Benefit from Split Income (TBSI) rules is required. Eligible recipients for income splitting within PRECs are clearly defined by TBSI regulations. Only family members meeting these definitions, actively engaged in the business for at least 20 hours weekly, and holding non-voting shares qualify.

When it comes to splitting methods, two options emerge: reasonable wage payments for services rendered or dividend distributions. It is preferred to have a salary instead of dividend distribution under TBSI as it is easier to provide evidence to show compliance to TBSI laws. It is also necessary to show a reasonable compensation aligned to the service rate in the market

Re-invest your Money in PREC for passive investments: With PREC you can use the excess funds to promote your business by investing in advertising or something else. However, in certain provinces, Ontario for example, allows you to invest in real estate holdings as well. It does not stop there OREA also mentions that Controlling Registrant i.e. controlling shareholder who owns voting and equity shares, can engage in business endeavors that have little or no relation to the real estate industry

Wait until a low-income year: If you’re into looking to spend a lot or you have other source of investment that is providing you with cash-inflows, in that case you can decide not to pay yourself. Remember, on a personal level you get taxed on a marginal tax bracket. Always, try to pay yourself only to sustain your lifestyle, do not redeem more than you’d want as this will place you at a higher tax bracket

Did you know: At Taxate we have Setup more than 100+ PREC!

Setup PRECThe Ultimate Guide to Landing Page Builders

Steps to Set Up Your Own Personal Real Estate Corporation

Setting up a Personal Real Estate Corporation (PREC) offers tax benefits, liability protection, and flexibility. Below are the steps to create your own PREC:

1. Understand the Concept: A PREC is a legal entity for your real estate business activities. It separates your personal assets from your business, providing protection and tax reductions through deductions and income splitting strategies.

2. Consult Professionals: Contact professionals as it requires complex legal and tax considerations involved in setting up a PREC.

3. Choose a Name and Structure: Pick a unique name that aligns with your business and decide on your corporation structure, taking into account factors like decision-making, tax planning, and future growth.

4. Register Your Corporation: Register your PREC with the relevant government authorities by filing necessary incorporation documents and paying any required fees.

5. Obtain Required Licenses: Ensure you have appropriate licenses or permits for operating as a real estate professional in your jurisdiction.

6. Set Up Corporate Bank Accounts and Financial Records: Open a bank account under your PREC's name for separate business finances and maintain precise financial records for tax compliance and financial reporting.

7. Develop a Business Plan: Create a detailed business plan outlining your goals, target market, marketing strategies, and financial projections to guide your operations.

Remember, the steps may vary depending on your jurisdiction, so consult local experts and research specific requirements and regulations. Following these steps and obtaining professional advice can help leverage the benefits of a PREC, elevating your real estate career.